Practices of all sizes are overcome by costly paper-based and manual processes that slow down business and leave them missing out on opportunities. Streamlining and automating your inbound workflow can help your practice become more efficient year-round.

Creating the paperless process

When it comes to improving workflows, paper based processes continue to slow things down. Successful implementation of an invoice automated solution has many benefits, including:

- Eliminate paper invoice setbacks

- Improve efficiency and profitability

- Increase control, visibility, and reporting

- Serve clients better

If you are still using paper processes to register supplier invoices and entering data to capture financial statuses, you are not alone. However, more and more accountants are realising they must start automating in order to stay competitive.

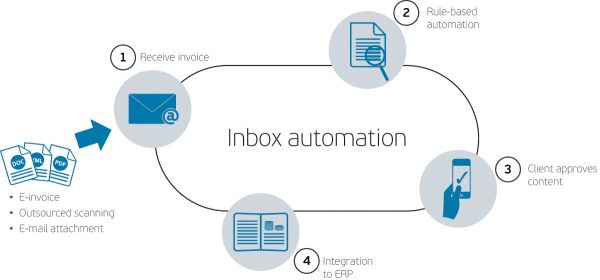

The first step in streamlining financial data flow is to eliminate paper so that data can drive the recording of your financial transactions. Using an inbound automation system creates a paperless process for input of supplier invoices.

Why you should make the transition

Digitising data makes it possible to move a process from manual to automatic and gives accountants the possibility to add automation and functionality. Moving over to electronic and digital processes boosts productivity and frees up time and energy. This leaves you with more time to focus on initiatives like financial advisory services or taking on more clients.

Workflow automation streamlines financial management and provides a totally secure audit trail for backtracking transactions. It also removes all the unnecessary steps that the paper based processes require. By adopting a digital workflow, invoices can be handled much faster, which is good news for those receiving many invoices. The result is faster invoice handling times with the ability to triple the invoice volumes handled, without adding staff or overhead.

The ideal goal is straight-through processing where the invoice is processed by the automated workflow from purchase to payment – all without human intervention.

Technology continues to give accountants a competitive edge in new ways. Those companies that learn to harness technology for workflow processes will have an even greater competitive advantage because of their efficiency, flexibility and extensibility.

Find out how you can boost your accounting practice’s success by automating your workflows by downloading our free guide.